The objective of this blog is to demonstrate how AI Decision-Making Software enhances business risk management through automation and intelligent analytics. It highlights how organizations can improve risk identification and mitigation, respond faster to emerging threats, enhance compliance accuracy, and reduce human error. By integrating intelligent analytics and automation, businesses can strengthen resilience, make data-driven decisions with greater precision, and gain a competitive edge in today’s dynamic market landscape.

From Reactive Defense to Predictive Advantage

Imagine your company foreseeing supply chain disruptions months in advance, detecting sophisticated fraud in real-time, and navigating complex regulatory changes with confidence. This is not science fiction; it is the new reality powered by AI Decision-Making Software.

In today’s volatile business environment, traditional risk management methods are reactive, slow, and reliant on historical data, leaving organizations vulnerable. AI decision intelligence platforms shift the paradigm from defensive risk mitigation to proactive strategic advantage, enabling companies to predict, prevent, and respond to risks faster than ever.

Understanding AI in Risk Management

AI in risk management uses machine learning, predictive analytics, and automation to identify, assess, and mitigate risks. Unlike traditional methods, it processes massive datasets in real time, uncovers hidden patterns, and delivers actionable insights. Monitoring early warning signs such as shifts in financial indicators, abnormal transaction behavior, or emerging operational anomalies. AI enables organizations to detect risks early and take proactive action before issues escalate.

Key benefits include:

- Faster identification of emerging risks

- Reduced human error in risk assessment

- Enhanced decision-making accuracy

- Significant cost and time efficiency

Did you know?

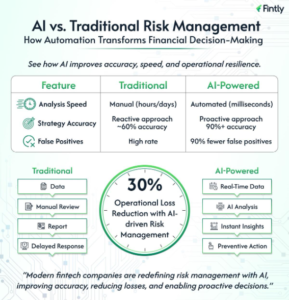

62% of enterprises using AI for risk management experienced a 30% reduction in operational losses within the first year.

AI vs Traditional Risk Management

| Informative Insight |

|---|

| The Evolution of Risk Intelligence: Traditional tools like SWOT analyses and risk matrices provide only static snapshots. In today’s interconnected world, risks shift rapidly due to market volatility or geopolitical events. Static tools cannot keep pace, leaving dangerous blind spots. AI decision platforms continuously learn and adapt, transforming risk management from a periodic exercise into a dynamic, real-time capability. |

Why AI Decision-Making Software is a Game-Changer

- Automated Risk Analysis: AI tools automate data collection and assessment, minimizing manual effort and errors.

- Predictive Analytics for Business: Algorithms anticipate risk scenarios, supporting proactive strategies.

- Continuous Monitoring: Real-time insights enable swift responses to evolving threats.

These capabilities allow companies to move from reactive to predictive risk management, strengthening resilience.

| Transform Your Risk Strategy Today |

|---|

| Is your organization still relying on outdated risk management methods? See how AI Decision Making Software can help you: |

| Predict risks before they materialize |

| Reduce operational losses by up to 30% |

| Improve fraud detection accuracy by 100% |

| Respond to threats 300% faster |

| [Book a Free Demo] → Discover your competitive advantage |

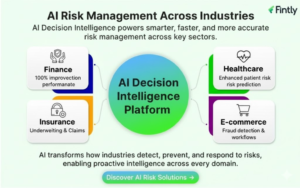

How Leading Industries Are Leveraging AI

Organizations across sectors are witnessing transformative results by implementing AI-powered decision automation.

- Financial Services: Fraud Detection and Prevention

Financial institutions deploy AI tools, including platforms such as Fintly, to analyze transaction patterns in real-time. By processing millions of data points, these systems identify suspicious activities that traditional rule-based systems miss. Banks use the software report to detect rate improvements of up to 100% while reducing false positives by 90%, significantly enhancing customer experience and protecting assets.

- Healthcare: Patient Risk Prediction

Healthcare providers leverage predictive software to forecast patient complications and readmission risks. By analyzing electronic health records and historical data, the platforms help clinicians intervene earlier. Hospitals implementing these solutions have reduced preventable readmissions by 25% to 35%, lowering costs while improving patient care quality.

- Cybersecurity: Threat Detection and Response

Enterprises face increasingly sophisticated cyber threats. AI software monitors network behavior continuously, detecting anomalies that signal potential breaches. Security teams using the platform respond to threats 300% faster, often neutralizing attacks before significant damage occurs.

- Supply Chain: Disruption Forecasting

Companies now use AI to monitor geopolitical events, weather patterns, supplier health, and logistics data. This comprehensive analysis enables platforms to predict disruptions of weeks or months in advance, allowing businesses to adjust sourcing, inventory, and distribution strategies proactively.

AI Risk Management Across Industries

Key Benefits of AI in Risk Management

- Precision and Speed: Instant processing of millions of data points improves accuracy.

- Scalability: AI decision automation adapts effortlessly as business complexity grows.

- Improved Compliance: Automated reporting reduces regulatory penalties.

- Bias-Free Analysis: The software removes cognitive biases from assessments, ensuring consistency.

As per McKinsey reports, companies using AI for risk functions can reduce fraud losses by up to 30% and improve efficiency by 40% to 50%.

Did you know?

AI-powered risk management systems can analyze over 160 billion transactions annually in real-time, processing each one in under 50 milliseconds. That is equivalent to analyzing every credit card transaction in the United States 40 times over in a single year. Traditional systems would require thousands of analysts working around the clock to achieve even a fraction of this capability.

| Informative Insight |

|---|

| From Reactive to Predictive: The true power of AI in risk management lies not just in faster detection but in prediction. While traditional tools identify risks after early warning signs appear, AI decision platforms analyze patterns across millions of variables to forecast risks weeks or months before they materialize. This shift represents a fundamental transformation in how businesses protect themselves and compete. |

Implementing AI Solutions: Practical Steps

- Identify Key Risk Areas: Start with high-impact problems (credit, compliance, or operational risk).

- Audit Data Quality: Clean, reliable data fuels accurate predictions.

- Select the Right Platform: Ensure integration with existing systems (ERP, CRM).

- Build Data Literacy: Train teams to collaborate with AI insights effectively.

| Ready to Stay Ahead of Risk? |

|---|

| Don’t wait for the next crisis to expose vulnerabilities in your risk management. Our AI Decision Making Software helps enterprises: |

| ✓ Identify hidden risks across operations |

| ✓ Automate compliance reporting |

| ✓ Scale risk management without adding headcount |

| ✓ Turn risk data into strategic insights |

| [Schedule Your Consultation] → See how AI transforms your risk posture |

Conclusion

AI Decision-Making Software is not just enhancing risk management; it is redefining it. From fraud detection to compliance and forecasting, the platform empowers businesses to anticipate threats, act swiftly, and turn risks into opportunities.

Enterprises that adopt this technology today will protect operations and gain a competitive edge in an uncertain world.

Ready to transform your risk strategy? Book a demo with Fintly to see how our AI Decision Making Software can help you stay ahead of risk.

Author

Subject Matter Experts (Lending) Fintly.co

Vijay Mali is a results-driven professional with deep expertise in HFC/NBFC startups, compliance, and underwriting. He specializes in delivering end-to-end solutions for financial institutions, focusing on Business Rule Engines (BRE), workflow automation, and AI-driven credit decision-making. He is passionate about leveraging Machine Learning (ML) scorecards and AI-powered risk assessment to optimize lending processes and drive digital transformation in the financial sector.