Enterprises face complex financial decisions due to vast data and manual workflows. According to PwC, automation boosts operational efficiency by 22%, highlighting the need for intelligent platforms that unify data, automate tasks, and enable consistent, data-driven decisions.

By leveraging rule-based automation software, organizations can configure and update business rules quickly without relying on IT teams, ensuring operational consistency and reducing errors in everyday financial tasks.

These platforms streamline decision-making processes and integrate predictive risk detection software to identify potential defaults early, strengthen compliance, and reduce risk exposure, helping financial institutions stay future-ready.

Introduction: The Shift Toward Intelligent Financial Decisions

Enterprises today face a growing challenge as data is expanding faster than decision-making processes can keep up. Manual operations and siloed financial systems struggle under this pressure, often causing slow approvals, inconsistent reports, and fragmented insights. These gaps create inefficiencies, increase errors, and risk missed opportunities.

Fintly’s intelligent business rules engine helps overcome these challenges by centralizing decision-making, automating routine workflows, and providing actionable insights. The platform enables finance teams to make timely, accurate, and consistent approvals with minimal manual effort.

The Hidden Costs of Manual and Disconnected Workflows

Many organizations still depend on legacy systems and fragmented data flows, leading to:

- High manual effort for finance teams

- Error-prone data handling

- Inconsistent insights and risky decisions

- Missed opportunities due to delays

Disconnected workflows can reduce enterprise efficiency. According to Deloitte, automation initiatives typically cut operational costs by 30% and boost productivity by 25%, making them a critical driver for financial institutions seeking scalability and compliance.

Adopting a business rules automation platform and a no-code business rules automation tool helps unify data, automate financial processes, and accelerate smarter decision-making.

Challenges and Solutions in Implementing Decision Automation

Implementing decision automation in financial enterprises can be complex. Here are five common challenges and practical solutions:

| Challenge | Description | Solution |

|---|---|---|

| Integration with Legacy Systems |

Older infrastructure often struggles to connect with modern tools. |

Choose a rule automation engine that offers flexible APIs for smooth integration. |

| Data

Security and Compliance |

Handling sensitive financial data requires strict adherence to regulations. |

Use an enterprise-grade BRMS solution with built-in compliance checks and auditable workflows. |

| Scalability Concerns |

As transaction volumes grow, systems must handle complexity without slowing down. |

Opt for a workflow automation platform designed for high scalability and real-time execution. |

| User Adoption and Training | Teams accustomed to manual processes may resist automation. | Provide intuitive interfaces and role-based training to make the transition easier. |

|

Cost and ROI Justification |

Decision automation requires upfront investment, and stakeholders often demand clear ROI. |

Highlight efficiency gains, compliance benefits, and faster turnaround times to justify the cost. |

Simplifying Complex Rules for Faster, Smarter Decisions

Modern automation tools empower organizations to manage logic visually no coding required:

- Configure or update rules without IT dependency

- Automate repetitive financial tasks to reduce errors and save time

- Apply enterprise policies consistently across departments

This approach helps finance teams shift focus from manual tasks to strategic analysis, improving speed and decision accuracy.

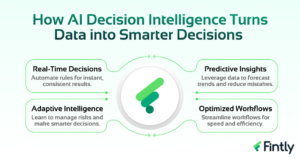

How AI Decision Intelligence Turns Data into Smarter Decisions

Fintly’s decision intelligence platform combine automation, analytics, and learning to transform decision processes:

- Real-Time Decision Automation:

Execute rules instantly using decision automation software, reducing manual effort and ensuring consistent outcomes.

- Predictive Insights:

The intelligent decision platform analyses historical data to forecast trends and minimises errors.

- Workflow Optimization:

An AI platform streamlines cross-departmental workflows for faster, more consistent outcomes.

- Adaptive Learning:

Intelligent business rules engine evolves continuously, enabling proactive risk management and data-backed decisions.

Why It Matters:

These capabilities don’t just simplify operations; they deliver measurable impacts. Predictive analytics improves credit risk accuracy by 25% and reduces fraud-detection false positives by up to 75%, enabling financial institutions to make faster, more reliable decisions.

Key Features That Make Decision Automation Effective

To help finance teams work faster, reduce errors, and make smarter choices, Fintly offers these powerful capabilities:

- From Manual to Instant: Centralized Insights for Faster Decisions

Unified dashboards provide enterprise-wide visibility, while predictive models drive faster, smarter, and data-driven decisions.

- Error-Free Efficiency: Compliance Without Stress

The decision engine reduces manual effort, accelerates compliance, credit evaluation, and risk assessment, freeing teams for strategic work.

- Learning Systems: Always Ahead of Risk

Intelligent business rules engines learn from historical patterns, improving predictive risk detection and adapting to evolving enterprise workflows.

- Seamless Collaboration: Teams That Move as One

Scalable architecture ensures smooth processes across teams, enabling consistent decisions and efficient collaboration.

- Actionable Insights on Demand: Decisions at Your Fingertips

The platform processes large-scale financial data efficiently and integrates with cloud-based rules platform and BRMS solutions for enterprise-wide decisions.

Why Fintly Stands Out

Fintly is not just another rules engine or workflow tool; it is an AI-driven Decision Intelligence Platform purpose-built for financial enterprises. It unifies policy, data, risk logic, and execution into a single, self-learning system. Here’s what sets Fintly apart:

- Unified Infrastructure:

A cloud-based business rules management system that centralizes data and workflows for finance, risk, and operations teams.

- No-Code Automation:

Configure and update business rules with a simple interface accelerating deployment while reducing IT dependency.

- Explainable Decisions:

Transparent, auditable workflows build stakeholder trust and support compliance.

- Real-Time Execution:

AI-powered decision automation software ensures instant, data-driven responses to operational or risk events.

- Enterprise-Grade Architecture:

A secure, scalable, and robust foundation ideal for banks, NBFCs, and financial institutions.

Fintly delivers measurable impact across the financial industry. By automating decision workflows, organizations can significantly reduce turnaround times, ensure compliance with regulatory standards, and handle higher volumes of transactions more efficiently.

These improvements not only accelerate operations but also enhance customer satisfaction and provide real-time visibility into decision workflows, strengthening risk management and audit readiness.

The Future of Predictive and Autonomous Decision-Making

Enterprise finance is shifting to predictive and autonomous ecosystems built to deliver faster approvals, smarter choices, and minimal manual effort. These innovations combine advanced analytics and process digitisation to boost accuracy, cut risk, and ensure compliance. Key trends shaping this future include:

- Strong Governance: Transparent and ethical frameworks that build trust in automated decision-making.

- Early Warning Systems:

Intelligent tools that detect potential defaults early, helping institutions reduce non-performing assets and maintain portfolio health.

- Enterprise Platforms:

Modern ecosystems like Modern Platforms for NBFCs and Banks enable continuous monitoring, real-time alerts, and proactive compliance management.

- Smarter Lending: AI-driven credit scoring models and machine learning credit scoring software speed up digital loan approvals while improving borrower evaluation.

- Predictive Analytics Tools: With advanced decision rules engine software, organizations can anticipate trends, simplify financial operations, and enhance data-driven strategies across lending and compliance.

These advancements help financial institutions reduce risk, improve forecasting accuracy, and enhance customer experiences, driving sustainable growth and resilience.

Empowering Finance Teams to Make Smarter Decisions

With decision rules engine software and workflow automation tools, finance teams can automate approval processes, enhance accuracy, and improve compliance.

Here, Fintly makes the difference. It turns data into actionable insights, streamlining credit underwriting with advanced tools such as a digital lending bank statement analyser, OCR-based bank statement analysis software, and predictive risk scoring systems for faster, more accurate evaluations.

Ready to transform your financial decision-making? Request a personalized demo with Fintly to see how Fintly empowers finance teams to automate decisions, accelerate approvals, and stay future-ready.

Author

Subject Matter Experts (Lending) Fintly.co

Vijay Mali is a results-driven professional with deep expertise in HFC/NBFC startups, compliance, and underwriting. He specializes in delivering end-to-end solutions for financial institutions, focusing on Business Rule Engines (BRE), workflow automation, and AI-driven credit decision-making. He is passionate about leveraging Machine Learning (ML) scorecards and AI-powered risk assessment to optimize lending processes and drive digital transformation in the financial sector.